YG PLUS establishes exclusive distribution contract with The Black Label

YG PLUS STAKEHOLDERS

YG Entertainment 30.22%

Weverse Company 10.23%

HYBE 7.67%

Yang Minseok 3.5%

Summary:

YGE (YG Entertainment) officially holds less than 50% of YG PLUS shares, it has the power to influence activities and exert an impact on profits. YG Entertainment stated that it includes YG PLUS as a subsidiary because it has the ability to instruct related activities and affect profitability.

YG PLUS's stock price is nearing its lowest level in three years, despite record-breaking financial results in 2022 and 2023.

The stock trends of YG PLUS closely follow YGE’s due to their parent-subsidiary relationship.

YG PLUS is actively working to diversify its customer base and minimize reliance on YGE, especially considering fluctuations related to BLACKPINK.

The potential success of The Black Label, led by Teddy, is crucial for YG PLUS's growth. The Black Label aims to debut a new girl group, and YG PLUS actively participates in exclusive distribution and business collaboration.

YG PLUS has secured a dominant market share in physical albums (41.5%) and digital music (20.10%) through its well-established business infrastructure.

Diversification efforts include partnerships with major music production companies like HYBE, reducing reliance on YG Entertainment and securing external popular IPs.

YG PLUS actively collaborates with external popular IPs, such as the virtual girl group ISEGYE IDOL, and small companies, contributing to its second IP business and potential MD business growth.

source: thebell.co.kr

This article, published on February 14, 2024, on The Bell's paid page, suggests that YG PLUS, a subsidiary of YG Entertainment, may see an opportunity for a stock rebound in 2024 due to its success as a leading domestic distributor of albums and music.

Anticipation is heightened with the debut of the new idol group from The Black Label, known for producing numerous hit songs led by producer Teddy under YG Entertainment. The Black Label has an exclusive distribution contract with YG PLUS.

As of the 13th, YG PLUS's stock price is nearing its lowest level in the past three years, closing at 4,200 won. Although it increased by 0.6% compared to the previous trading day, it is not at a high level compared to previous years. The 52-week low for YG PLUS is 4,000 won based on the closing price, reflecting a challenging stock situation.

Since the end of 2021, YG PLUS stock has been on a downward trend. Despite exceeding 10,000 won in November 2021, it's now barely holding in the 4,000 won range, marking a significant decline over the past 2-3 years.

The stock's performance contrasts sharply with YG PLUS's financial results, which have seen record-breaking figures in 2022 and 2023. However, the stock's decline appears to be heavily influenced by its parent company. An industry insider noted, "YG PLUS stock tends to be closely linked to the entertainment industry, especially the stock performance of YG Entertainment."

Examining the stock trends since 2019, YG PLUS has shown fluctuations alongside YG Entertainment's stock. When YG Entertainment's stock reacts to events like Blackpink's contract renewals, YG PLUS tends to follow suit, indicating a correlation between the two.

YG PLUS and YG Entertainment's stock trends are closely linked due to their parent-subsidiary relationship. YG PLUS's largest shareholder is YG Entertainment, holding a 30.22% stake. The top two shareholders, including Yang Hyun-suk, the largest shareholder of YG Entertainment, and his younger brother Yang Min-suk, who is also the CEO of YG Entertainment, hold a combined 3.47% stake.

While YG Entertainment officially holds less than 50% of YG PLUS shares, it has the power to influence activities and exert an impact on profits. YG Entertainment stated that it includes YG PLUS as a subsidiary because it has the ability to instruct related activities and affect profitability.

In this context, the decline in YG PLUS's stock can be attributed to adverse events at its parent company, YG Entertainment. Despite successfully securing a mega-IP contract with Blackpink in December of the previous year, YG Entertainment failed to sign exclusive contracts with individual members, leading to fluctuations in both YG PLUS and YG Entertainment stocks.

YG PLUS is actively working to bolster its stock through independent business efforts, aiming to secure customers outside of YG Entertainment and sustain its growth trajectory. This strategy positions YG PLUS to maintain a robust growth trend even if YG Entertainment's performance is impacted by fluctuations related to the Blackpink issue.

Diversifying its customer base, YG PLUS is eyeing the potential success of Double Black Label. Led by prominent producer Teddy, The Black Label Label includes artists like Taeyang from BigBang, Jeon Somi, and actor Park Bo-gum, along with singer Loren, the son of Naver's founder, Lee Hae-jin.

Although YG Entertainment officially holds a 21.59% stake in The Black Label, the latter is essentially considered an independent label founded by Teddy. Despite this, YG PLUS sees a significant business connection with The Black Label, especially considering the upcoming debut of a new idol group under Teddy's leadership.

The Black Label aims to debut a new girl group this year, generating attention even before their official debut. The success of pre-debut buzz is crucial for the group's post-debut impact. YG PLUS is actively involved in the exclusive distribution of The Black Label's domestic and international music, strengthening its ties with the label.

A YG PLUS spokesperson stated, "We are enhancing new businesses to fill the performance gap caused by Blackpink in 2024. We actively collaborate with YG Entertainment's rookie artists and pursue external popular IP-related businesses."

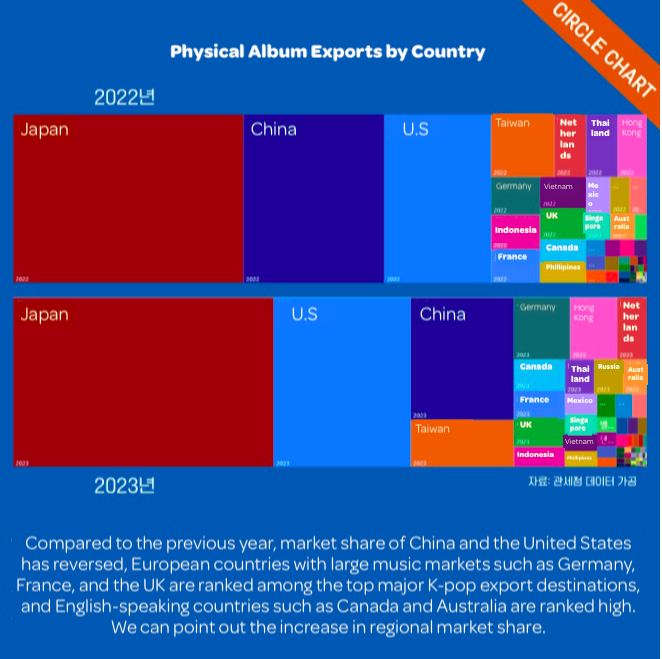

The ability of YG PLUS to exclusively distribute The Black Label's music is attributed to its well-established business infrastructure. As of the first half of 2023, YG PLUS secured a market share of 41.5% in the physical album sector and 20.10% in the digital music sector, making it the leader in physical albums and second in digital music.

However, discussions are still ongoing regarding merchandise (MD) production, such as goods related to idols. The MD business related to idols is considered one of the most profitable areas, especially in conjunction with concerts. It's noted that there haven't been specific requests from Double Black Label in this regard.

Diversifying its customer base beyond YG Entertainment is a strategic move for YG PLUS to ensure financial stability. Relying solely on YG Entertainment would expose YG PLUS to the immediate impact of activity gaps from artists like Blackpink. Diversification helps mitigate such impacts.

YG PLUS has established strong partnerships with major music production companies, with HYBE being a prominent example. YG PLUS has formed robust partnerships with HYBE and its affiliate, Weverse Company, which hold 7.67% and 10.23% of YG PLUS shares, respectively.

This collaboration has allowed YG PLUS to decrease its reliance on revenue from YG Entertainment. As of the third quarter of the previous year, the transactions with YG Entertainment accounted for 17.9% of the total consolidated revenue, totaling 310 billion won. This marked a decrease from 23.1% at the end of the previous year.

Furthermore, starting in the second half of the previous year, the virtual girl group 'ISEGYE IDOL' has reportedly contributed significantly to YG PLUS's performance. ISEGYE IDOL is a six-member group planned and established by streamer 'Woowakgood.' They debuted in December 2021 with the song 'RE:WIND.'

A YG PLUS representative stated, "We are expanding our second IP business by utilizing strong external popular IPs such as ISEGYE IDOL, which has formed a powerful fandom." They added, "We aim to become a companion for music business stakeholders by supporting various events, not only planning, producing, and selling but also pop-up stores."

The integration of external popular IPs into the business is positive not only for music and album distribution but also for potentially lucrative merchandise (MD) business. The representative mentioned, "Many small planning companies lack the capability to independently conduct MD business," and expressed that collaboration with small planning companies could lead to mutually beneficial relationships.