2023 Kpop Physical Album Export Data Review

Source Written by Kim Jinwoo, Chief Research Fellow, Circle Chart

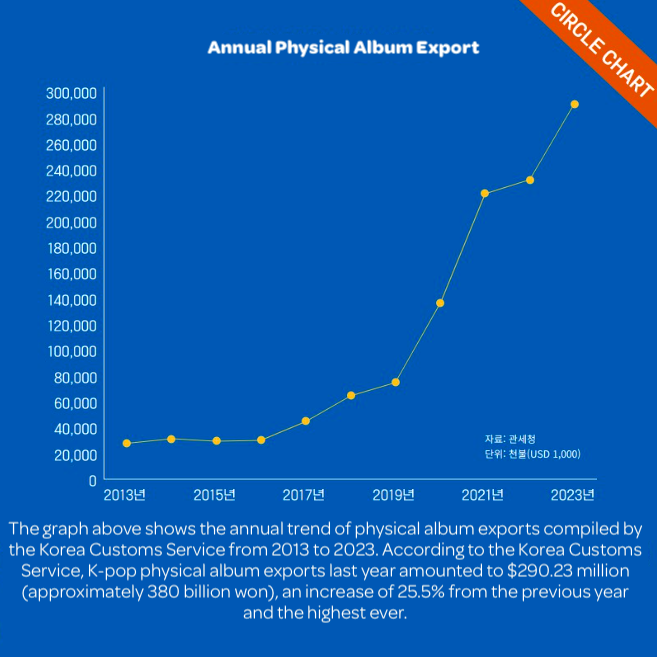

K-pop physical album exports reached all-time high in 2023

"K-pop physical album exports increased by 25.5% compared to the previous year, once again reaching an all-time high. In terms of content, market share increased in Europe and English-speaking regions such as Germany, the UK, the US, Canada, and Australia, while market share in China plummeted and market share decreased in major Southeast Asian countries. The increase in exports to North America and Europe appears to be due to the K-pop industry's recent growth strategy targeting Western countries. On the other hand, the reason for the sluggish export of K-pop in the Southeast Asian market is thought to be the result of the emergence of K-pop style idols that can replace K-pop in the region and the reaction of the K-pop industry's strategic activities targeting the Western market. It is ironic that while K-pop is being produced targeting the Western world by removing the letter K, including recently increasing the use of English in lyrics, local K-pop style idols are appearing in Southeast Asia singing songs with Korean lyrics inserted, as if to secure the legitimacy of K-pop. A phenomenon is also occurring.The downturn in exports in the Southeast Asian market is now considered a constant rather than a variable. This year, the stability of the previously unstable Chinese market and the expansion of market share in European and English-speaking countries, which are within the top 10 in the global music market, will be key factors in the physical album export market."According to the Korea Customs Service, K-pop physical album exports last year amounted to $290.23 million (approximately 380 billion won), an increase of 25.5% from the previous year and the highest ever.

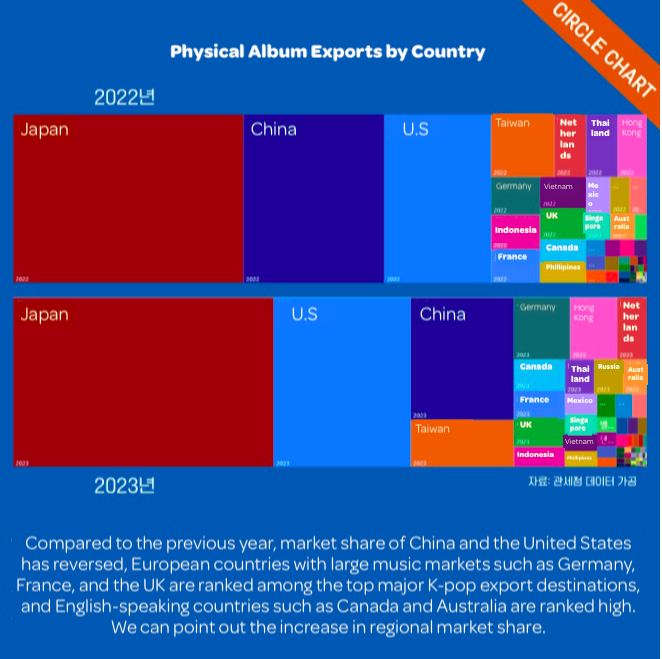

As a result of analysis based on Korea Customs Service data, what is special compared to the previous year is that the market share of China and the United States has reversed, European countries with large music markets such as Germany, France, and the UK are ranked among the top major K-pop export destinations, and English-speaking countries such as Canada and Australia are ranked high. We can point out the increase in regional market share.

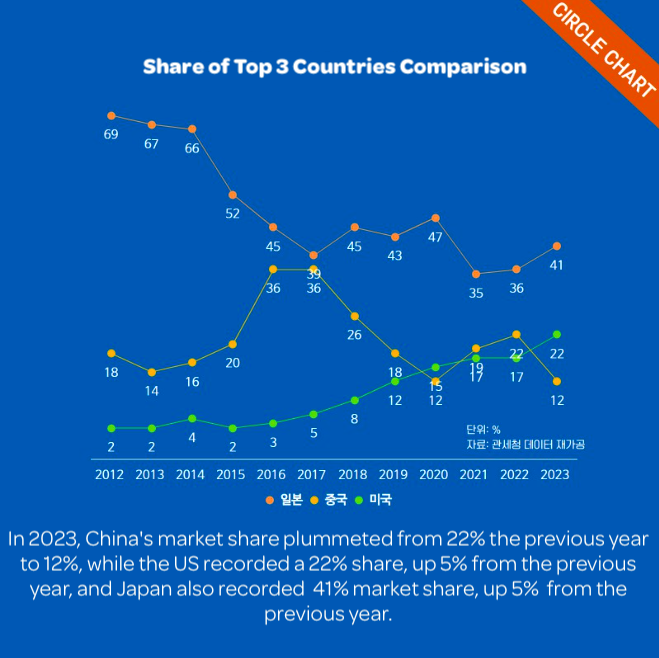

In 2023, China's market share plummeted from 22% the previous year to 12%, while the US recorded a 22% share, up 5% from the previous year, and Japan also recorded a 41% market share, up 5% from the previous year.

According to data from the Korea Customs Service, the combined market share of the three major export countries for K-pop albums over the past five years has been 72% to 75%, and is expected to be 74% in 2023.

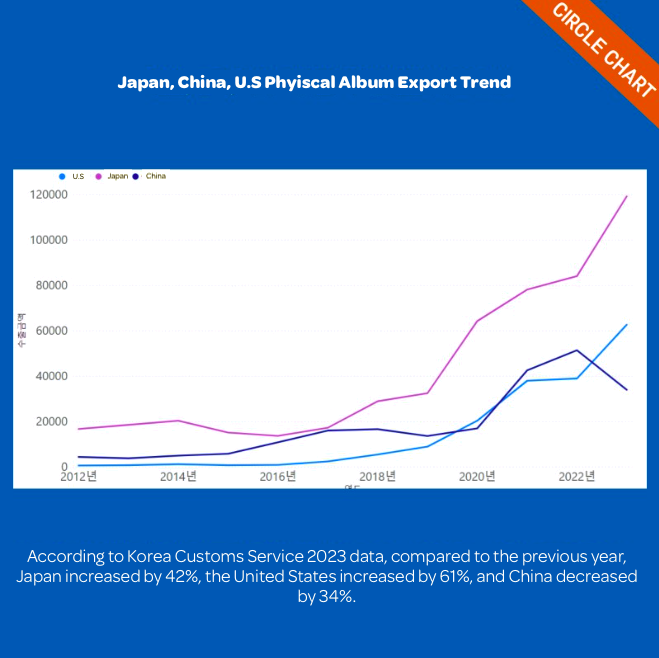

According to three years of Korea Customs Service data, compared to the previous year, Japan increased by 42%, the United States increased by 61%, and China decreased by 34%.

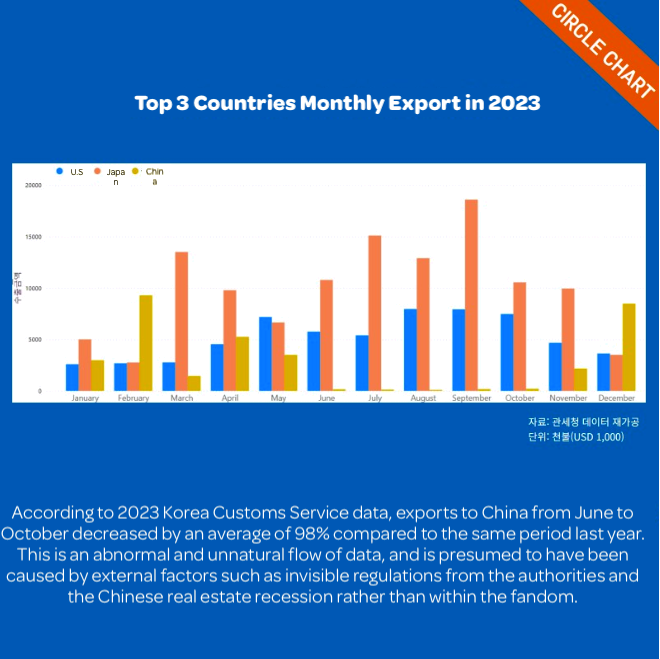

According to 2023 Korea Customs Service data, exports to China from June to October decreased by an average of 98% compared to the same period last year. This is an abnormal and unnatural flow of data, and is presumed to have been caused by external factors such as invisible regulations from the authorities and the Chinese real estate recession rather than within the fandom.

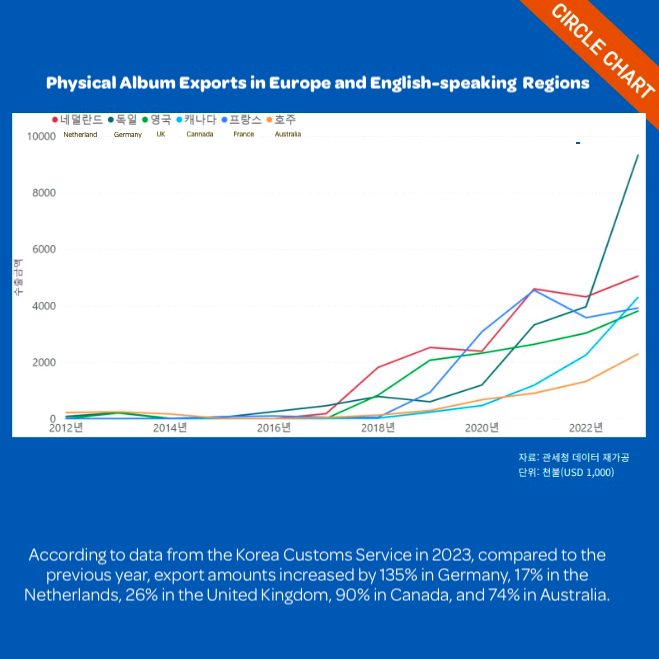

According to data from the Korea Customs Service in 2023, compared to the previous year, export amounts increased by 135% in Germany, 17% in the Netherlands, 26% in the United Kingdom, 90% in Canada, and 74% in Australia.

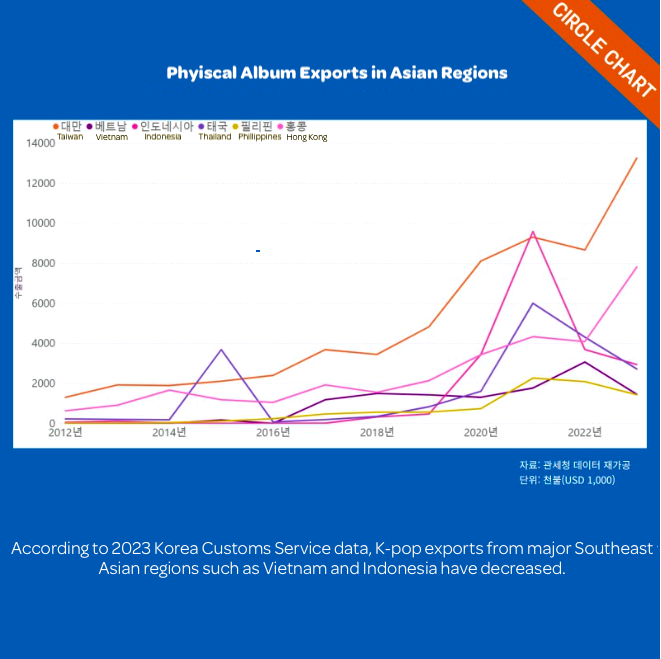

According to 2023 Korea Customs Service data, K-pop exports from major Southeast Asian regions such as Vietnam and Indonesia have decreased.

Source Written by Kim Jinwoo, Chief Research Fellow, Circle Chart