YG Entertainment is currently trading at 31,450 KRW as of 2:25 PM on the 4th, down 6.54% from the previous day. However, trading volume has surged by 300.1% compared to the previous day, surpassing the highest volume in the past five trading days.

YG Entertainment reported revenue of 569.2 billion KRW and an operating profit of 86.9 billion KRW in 2023, reflecting a 45.5% increase in revenue and an 86.4% increase in operating profit compared to the previous year. These growth rates place the company in the top 9% for revenue and the top 15% for operating profit in KOSDAQ.

Big Revenue Trend

Over the past three years, YG Entertainment has shown steady growth, with increasing revenue each year. As the business grows, the company’s corporate tax payments have also risen. Last year, YG paid 15.5 billion KRW in corporate taxes, a 6.9% increase from 14.5 billion KRW in 2022, driven by a significant rise in net profit. The company's effective corporate tax rate was 16.6%.

Corporate tax payments have consistently increased over the past three years, from 14 billion KRW to 14.5 billion KRW, and then to 15.5 billion KRW.

Big4 Profit Trend

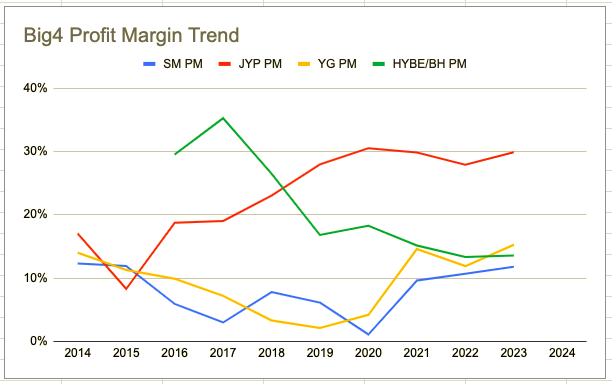

Big4 Profit Margin Trend

On August 19, Hanwha Investment & Securities analyst Park Soo-young commented on YG Entertainment, stating: "For Q2, the company recorded consolidated revenue of 90 billion KRW and an operating loss of 11 billion KRW, marking another loss following Q1. The 'Buy' recommendation is maintained, but the target price is lowered to 41,000 KRW. Due to limited IP activity this year, amortization costs remain a burden, making consecutive quarterly losses inevitable. Next year’s full activities from BLACKPINK (album releases + world tour) may drive significant growth, but it will be difficult to achieve profitability on par with 2023 due to high amortization and cost increases. As mentioned, the company's risk lies in new IPs like BABYMONSTER, and it will take time to see results, likely until next year. Based on lower estimates, the target price has been reduced."